Through the centuries, China’s entrepreneurs accessed finance from family and friends through social networks referred to as . Even after the communist revolution, these networks helped to propagate a thriving small business sector that invested in local services and basic manufactured goods.

In the late Nineteen Seventies and Nineteen Eighties, when President Deng Xiaoping began to open up the economy, it didn’t take long to rekindle the innate entrepreneurial spirit that saw China’s traders conquer the old Silk Road. Following the ascendance of tech juggernauts Alibaba, Tencent and Baidu, coupled with later market liberalisations, there was an explosion of each local and western enterprise capitalists desperate to find the following generation of Chinese unicorns.

China now has the largest enterprise capital market in Asia, second only to the US worldwide. This is all of the more extraordinary provided that the communist Chinese structure didn’t formally recognise the legitimacy of personal enterprise until 1988.

In the wake of the COVID-19 pandemic, nonetheless, this vitally necessary source of finance for entrepreneurs was at all times prone to be under serious threat. Unlike banks, which might make decisions about business lending using automated credit scoring, enterprise capitalists and angel investors depend on meeting entrepreneurs head to head to evaluate whether their start-ups are investable.

imtm photo

Because China was the primary country to be adversely affected by COVID-19, we decided to look at how this sector has been affected. This, we hoped, would help gauge what’s prone to be happening to other economies now in economic meltdown. The results usually are not pretty.

What we found

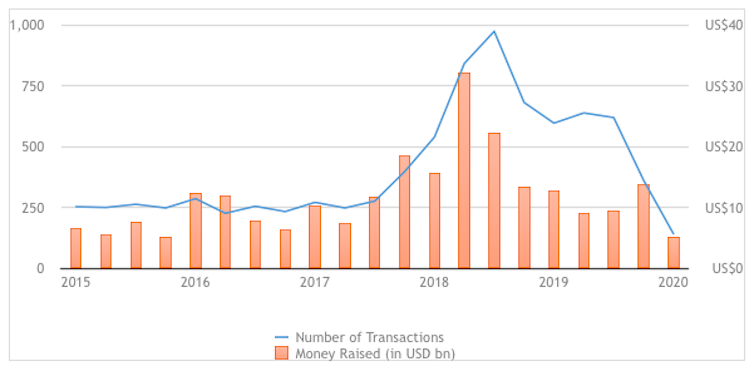

We discovered that because the outbreak of the coronavirus in China, there was a dramatic decrease in aggregate levels of investors taking stakes in latest businesses. Across the total spectrum of enterprise capital, from investments in brand latest corporations to those which are already profitable, we found a 60% decline in the primary quarter of 2020 in comparison with 2019.

To put this into perspective, that is 3 times the scale of the decrease in the course of the global financial crisis of 2007-09. Some estimate that if a drop like this were to occur globally, roughly US$28 billion (£23 billion) in start-up funding could possibly be lost.

When we checked out seed-stage investments – those typically dominated by the smallest and youngest start-ups – they almost totally disappeared in China in the course of the first quarter of the yr. There were fewer than 20 deals in total, representing an 86% reduction yr on yr. In other words, start-ups during this crisis have been all but starved of latest finance.

China seed-stage funding 2015-20

Ross Brown and Augusto Rocha

The sectors that profit most from seed funding in China are education, e-commerce, media and entertainment, healthcare and AI/robotics. Most of the cash comes from local Chinese investors, and this might be a great barometer of the areas of the economy worst affected by the crisis – education and entertainment above all.

In contrast, larger later-stage enterprise capital deals are being less adversely affected. This could also be because many deals are funded by investors which are foreign-owned, often from places only hit by the pandemic later within the quarter. Significant foreign-owned investors include Sequoia of the US, Japan’s Softbank and the UK’s Baillie Gifford, in addition to sovereign funds just like the Qatar Investment Authority.

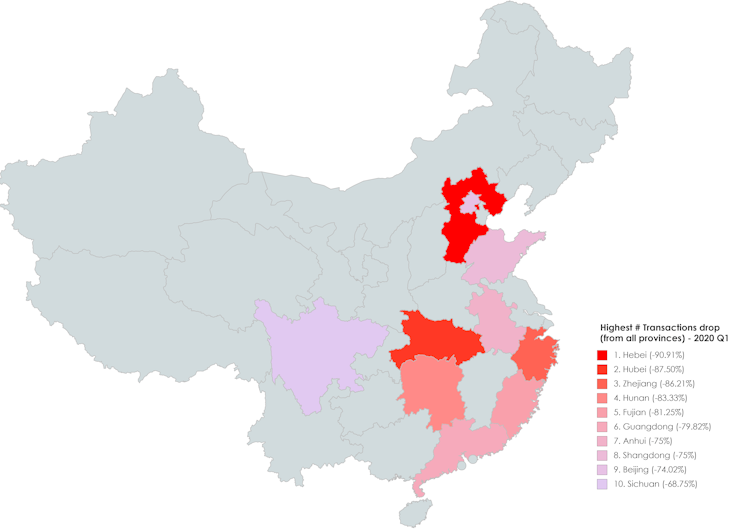

We also examined which areas in China were most negatively affected. Traditionally, entrepreneurial finance was concentrated in Beijing, Shanghai and Shenzen, though in recent times, investors spread their nets across the country. Now, nonetheless, there appears to be a worrying retrenchment. Some provinces seeing the best decreases in investment are the identical ones worst affected by the virus – Hubei, Zhejian and Hunan.

Worst affected provinces, Q1 2020 vs Q1 2019

Ross Brown and Augusto Rocha

The UK situation

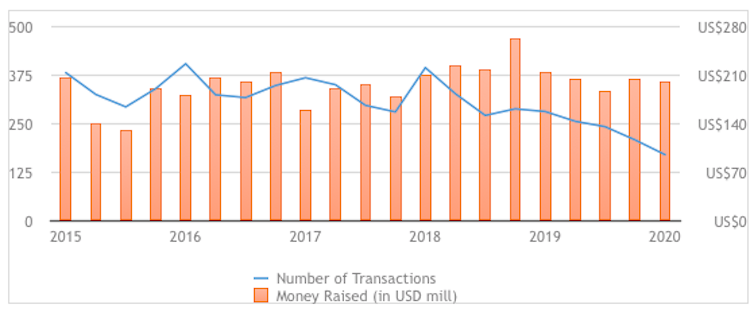

The UK relies more on enterprise capital than most European countries, so our Chinese data begs necessary questions on what is occurring closer to home. From our evaluation, we detect a marked drop in entrepreneurial finance in the primary quarter of 2020. Like China, the youngest and smallest start-ups are those most affected by the crisis, though other stages of the investment process have been hit too.

UK seed funding, 2015-20

Ross Brown and Augusto Rocha

From the chart above, the variety of seed-funding transactions within the UK actually halved between the primary quarter of 2018 and the primary quarter of 2020. It could possibly be that this was initially as a consequence of uncertainties brought on by Brexit, then accentuated by the pandemic.

We can safely assume that the figures for the second quarter of 2020 will show further dramatic declines. The uncertainty suffocating entrepreneurial activity within the UK has already had an enormous impact on the economy. Early figures show that the variety of firms going bankrupt in March was 70% higher than the identical month last yr, while registrations of start-ups fell by 1 / 4. Clearly this crisis is unlike any in modern times.

The UK government has just launched a suite of support packages including the £500 million Future Fund and a £750 million fund to focus on support for modern small and medium-sized enterprises (SMEs). Importantly, these schemes rely upon co-investments between the private sector and the general public sector, which can mitigate the declines in private equity investment. But so long as enterprise capitalists and business angels are unable to physically meet up with entrepreneurs, this sort of finance is prone to proceed to be thin on the bottom.

This article was originally published at theconversation.com