It’s nearly a decade for the reason that term “fourth industrial revolution” was coined, yet many individuals won’t have heard of it, or know what it refers to.

Also generally known as industry 4.0, it’s a way of describing how connecting together different advanced technologies could transform how we make things. An example of this may very well be putting artificial intelligence (AI) into factory robots.

Although there’s no formal agreement we live through this latest age, it’s an indication of the importance with which many individuals regard these developments and their potential. The previous industrial revolutions were: the rise of steam power within the late 18th century, the use of electricity to power machines at the top of the nineteenth century and the shift to digital electronics that began within the Seventies.

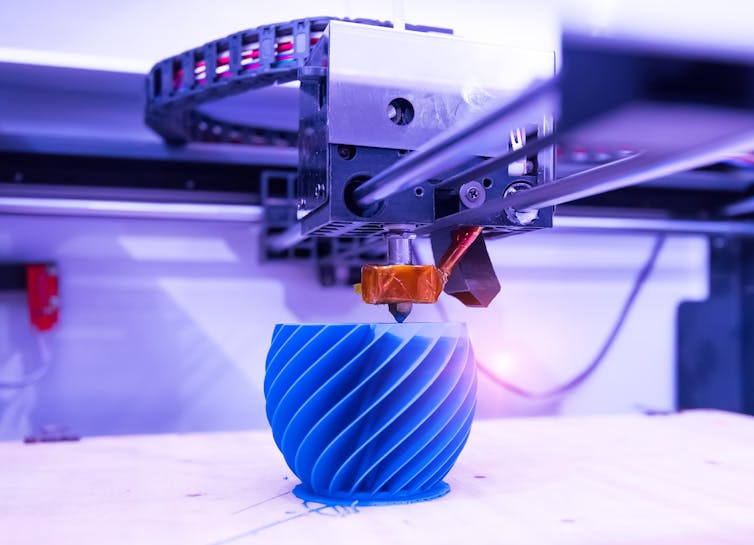

These were defined by clear milestones. But many emerging technologies could claim to be a part of industry 4.0. These include virtual reality (VR) to simulate what’s occurring in an assembly line, and 3D printing. There are also lesser known developments comparable to digital twins – virtual models that accurately reflect the behaviour of physical objects comparable to wind turbines or aircraft engines.

Any technology that’s “smart” or “cyber-physical” — where the lines between the digital and physical worlds are blurred — can claim to be a part of the fourth industrial revolution.

But many firms appear to have been slow to benefit from these developments. Here, we’ll show why that may very well be and the changes that could be mandatory to make sure that transformative technologies live as much as their potential.

A stalled revolution?

A supply chain describes your entire system for producing a product, from raw materials to delivering the finished article to a consumer. So it’s useful to take a look at the impact industry 4.0 technologies have had on these chains.

It’s difficult to measure how much of an effect specific technologies is perhaps having on the economy. However, one thing we will do is see what impact they’ve made on decision makers in firms.

One of us (Ralf Seifert) recently published a survey of several hundred senior executives conducted. The survey asked the executives their views on managing supply chains.

None of the highest priorities listed by the executives relate to industry 4.0. Headline-grabbing technologies strongly related to the fourth industrial revolution, comparable to AI and machine learning, the web of things, robotics and 3D printing are in the underside third of priorities.

A take a look at online trends also reveals that searches for “industry 4.0” peaked in 2019, but have since dropped to a significantly lower level.

Shutterstock

There may very well be plenty of potential reasons for this disappointing embrace of industry 4.0 by firms. In 2020, a survey by the accounting giant KPMG showed that, of all industry 4.0 technologies, only cloud computing had reached a sophisticated — though still incomplete — level of implementation.

For many businesses, the advantages of other vital technologies remain obscure. The day by day pressures of service and price take precedent, so it takes effort to maneuver away from familiar solutions. This is consistent with the dip in searches for industry 4.0 — whilst global supply chains have been disrupted by the coronavirus pandemic, the blockage of the Suez Canal shipping lane in 2021, floods hampering rail transport and a shortage of shipping containers.

The KPMG report from 2020 found that lower than half of business leaders had an excellent understanding of the term “fourth industrial revolution”.

High risk, high scrutiny

A lack of know-how is one hurdle for the adoption of industry 4.0 technologies. Another is the necessity to construct the business case for expenditure on latest technological solutions.

The more ambitious the technology, the upper the danger and scrutiny. Not every company has leaders able to champion and sponsor innovation within the face of uncertain or less tangible outcomes.

Shutterstock

Industry 4.0 initiatives also can result in resistance to vary amongst employees. IT departments, trained for years to hunt down large enterprise solution providers, hesitate to recommend area of interest solutions from small firms — especially for technologies they’re not conversant in.

One strategy to address that is to commit resources to constructing separate teams tasked with identifying and prioritising industry 4.0 capabilities. Even then, nonetheless, there should be an alignment with the broader business strategies of an organization.

From crisis to opportunity

The unprecedented supply chain disruptions during the last two years have pushed executives to think about reconfiguring their supply chains. More often than not, nonetheless, they’re opting to do that in a standard manner.

Reshoring (returning manufacturing to the corporate’s original country) and nearshoring (transferring manufacturing to a closer-by, relatively than more distant, country) have grow to be popular options for firms trying to construct the resilience of their supply chains.

Industry 4.0 technologies have a job to play on this transition. For example, the rethinking of world supply chains got here about through a necessity to cut back labour costs.

Driverless forklifts, or automated guided vehicles (AGVs), are one example of the best way robotics can mitigate rising costs elsewhere. Additive manufacturing — the commercial name for 3D printing — can simplify and reduce the fee of production processes that involve two or more costly steps.

For supply chains that cross international borders, there will probably be an added incentive to make use of digital platforms for improving the power to trace inventory — a term covering the whole lot from raw materials to finished products — and to assist transport goods. This will help firms discover unplanned disruptions more quickly and react to them appropriately.

The very supply chain dysfunctions that made headlines and arguably slowed the short-term progress of industry 4.0 may yet prove to be the engine that finally delivers its promise.

This article was originally published at theconversation.com